BPR 377: Withholding of dividends tax at a reduced rate

This ruling determines the dividends withholding tax consequences resulting from the declaration of a dividend by a company to a trust where certain non-resident beneficiaries of that trust are the beneficial owners of these dividends.

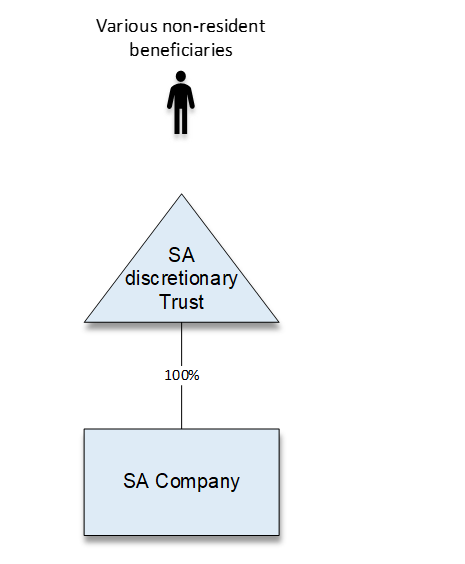

The parties to the ruling were as follows:

- The applicant: A resident company

- The co-applicant: A resident trust

- Beneficiaries: Non-resident beneficiaries of the co-applicant (i.e. the resident trust)

The structure is illustrated below:

Typically, dividends declared by a resident company to a resident non-corporate person will be subject to dividends withholding tax (“DWT”) at a rate of 20%.

However, where the beneficial owners of the dividend are non-resident, the relevant double taxation agreement (“DTA”) could apply to reduce the DWT rate.

In the present circumstances, although involving a resident trust, the transaction appears to have been structured to the effect that the trust beneficiaries (and not the trust itself) are viewed as being the “beneficial owners” of the dividend.

This aligns with the “conduit principle” in terms whereof income received by or accrued to a trust which is distributed to its beneficiaries prior to the trusts’ tax year end, essentially flows through to the beneficiaries without touching the trust at all, and without altering the nature of the income (i.e. a dividend remains a dividend).

Whilst this would be standard had the trust been a vested trust, the above scenario is unique as the trust is discretionary in nature.

Presumably because, on a date preceding the actual declaration of such dividend, the trustees will take a resolution to vest any dividend declared by the applicant in that year in the beneficiaries, SARS has ruled that the applicant should withhold dividends tax at a reduced rate as contemplated in section 64G(3), provided that the declarations and written undertakings contemplated in section 64G(3)(a) and (b) will be submitted before payment of the dividend.

Find a copy of BPR 377 here.

15/09/2022