BPR 375: Unbundling of shares in a CFC

This ruling determines the tax consequences of an unbundling transaction, in terms of section 46 of the Income Tax Act 58 of 1962 (“IT Act”), of the shares in a controlled foreign company (“CFC”).

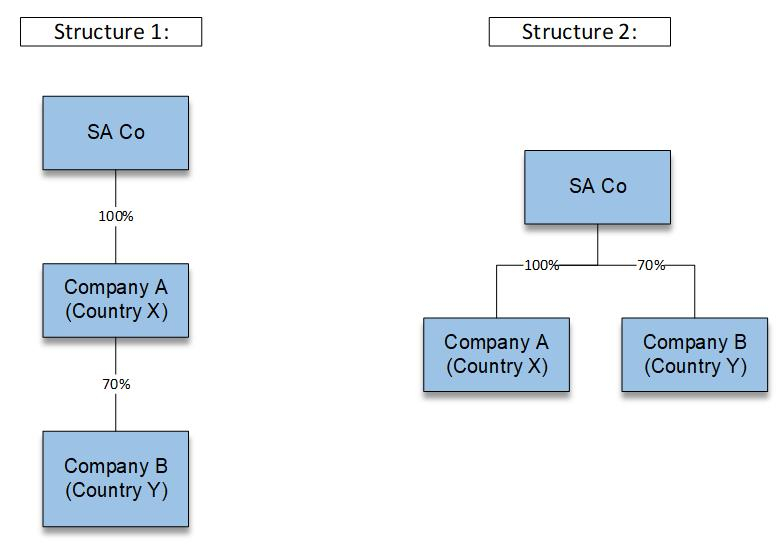

The parties to the proposed transaction:

- The applicant: A resident company

- Company A: A CFC that is a resident of country X and a wholly owned subsidiary of the applicant

- Company B: A CFC that is a resident of country Y and 70 per cent held by Company A

The applicant and its subsidiaries would like to restructure the group as there is no economic benefit for the applicant holding Company B via Company A.

The applicant prefers to exercise direct control over its investment in Company B and the revised structure will place all the applicant’s subsidiaries at the same level without administrative hurdles. The proposed transaction entails Company A unbundling all its shares in Company B to the applicant.

The above transaction has the effect that the group structure changes as follows:

Ruling:

The ruling made in connection with the proposed transaction is as follows:

(a) The proposed distribution by Company A of the shares held in Company B to the applicant will constitute an “unbundling transaction” as defined in paragraph (b) of the definition of that term in section 46(1).

(b) In terms of section 46(2) Company A must disregard the distribution of the shares in Company B for purposes of determining its taxable income or assessed loss or its net income as contemplated in section 9D.

(c) The distribution of the shares by Company A must be disregarded in determining any liability for dividends tax in terms of section 46(5).

Find a copy of the BPR here.

16/08/2022