Amendments to IAS 7 and IFRS 7: Supplier finance arrangements

What is a supplier finance arrangement?

Supplier finance arrangements (sometimes referred to as reverse factoring or payables/supply chain finance) may sound foreign but are more common than one may think.

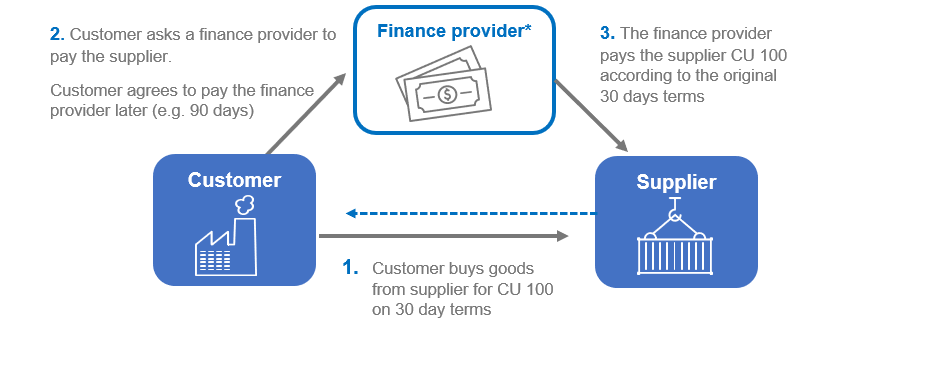

In a nutshell, this is where a supplier provides goods/services to a customer and instead of paying the supplier directly, the customer enters into an arrangement with a finance provider (for example, a bank) to settle the account with the supplier on their behalf. The finance provider will generally settle with the supplier according to the original terms (or earlier at a discount), and the customer will settle with the finance provider on extended payment terms.

To illustrate:

*The finance provider can be the customer’s, the supplier’s or third party.

Why enter into these arrangements?

Cash management.

The customer is able to agree to longer terms with the finance provider to pay for those goods, perhaps 60/90 days instead of 30 days and the supplier is still able to receive their payment within the agreed terms.

Sometimes the agreement allows the supplier to receive payment from the finance provider immediately - in which case the supplier might take a small discount. Where suppliers take a discount for early payment, this is typically based on the customer’s credit rating, not the supplier. This may be very beneficial to smaller suppliers with poorer credit ratings as they are potentially able to access funds earlier at a cheaper rate than obtaining a loan with the finance provider directly.

These arrangements are also beneficial for the customers with poorer credit ratings to extend their payment terms.

Current IFRS considerations

What considerations must be made when presenting and disclosing these arrangements before the amendments? The IFRIC (IFRS interpretations committee) looked into it and their response has been incorporated below.

Statement of financial position

Trade and other payables are required to be presented separately from other financial liabilities, and presentation of additional line items is required where relevant to the user’s understanding of an entity’s financial position (IAS 1 Presentation of Financial Statements).

On this basis, liabilities from supplier financing arrangements would need to be presented:

- within trade and other payables;

- within other financial liabilities; or

- as a separate line item

Keep in mind that trade payables are liabilities to pay for goods or services that have been received or supplied and have been invoiced or formally agreed with the supplier, and are part of the working capital used in the entity’s normal operating cycle (IAS 37.11(a) and IAS 1.70).

Factors that could be considered in determining whether it is still appropriate to present these as trade payables:

- whether additional security is provided as part of the supplier financing arrangement that would otherwise not be provided;

- the extent to which the terms of these liabilities differ from the terms of the entity’s trade payables that are not part of the supplier financing arrangement.

Cash flow statement

Should cash flows under supplier financing arrangements be classified as cash flows from operating activities or cash flows from financing activities?

Operating activities are “the principal revenue-producing activities of the entity and other activities that are not investing or financing activities”; and

Financing activities are “activities that result in changes in the size and composition of the contributed equity and borrowings of the entity” (IAS 7)

If the liability is a trade payable, this must be presented as cash flows from operating activities.

If the liability is not considered a trade payable, for example where the liability represents borrowings, the cash outflows to settle the liability must be presented as part of financing activities.

Liquidity risk

IFRS 7 requires qualitative and quantitative disclosures regarding exposure to liquidity risk, and the objectives, policies and processes for managing the risk.

What are some of the risks associated with supplier finance arrangements?

Entering into supplier finance arrangements may result in the entity concentrating a significant portion of their liabilities with one finance provider rather than with a diverse group suppliers. Keep in mind that entities are likely to obtain other funding from these finance providers too (i.e. outside of these arrangements).

This poses a potential liquidity risk because, if there is difficulty in meeting an obligation to this finance provider the entity may end up in a position where they need to pay a significant amount, within a short period of time (or on demand), to a single counterparty.

The entity may become reliant on these extended payment terms or the supplier may become reliant on earlier payment allowed by these arrangements. If the finance provider, for whatever reason, decided to stop entering into these arrangements this could have significant implications, and may impact the entity’s ability to settle obligations when due.

Ensuring that these arrangements are presented and disclosed appropriately in the financial statements may require the entity to apply significant judgement. These judgements must be disclosed in sufficient detail.

For detail around the previous IFRIC discussion on this matter please follow this link.

The amendments are intended to enhance readers understanding of the exposure of an entity to supplier finance agreements. These will extend over and above the considerations discussed above.

What are the amendments?

IAS 7 | |

Objective Paragraph added: IAS 7.44F & 44G |

To disclose information about supplier finance arrangements that enables users of financial statements to assess the effects of those arrangements on the entity’s liabilities and cash flows.

The IASB has included a paragraph to explain the general characteristics of these arrangements.

|

How to meet the objective Paragraphs added: IAS 7.44H (a)-(c)

|

The following disclosures would need to be made in aggregate for supplier finance arrangements:

If ranges are wide explanatory information should be added

|

Effective date and transition Paragraphs added: IAS 7.62-63(a)-(c) |

Effective for annual reporting periods beginning on or after 1 January 2024, with early application permitted.

Entities will not need to disclose:

The effective date is equally applicable to the IFRS 7 amendment |

IFRS 7 | |

Supplier finance arrangements will be specifically included in the quantitative liquidity risk disclosures

Paragraph added: IFRS 7.B11F

|

Entities must disclose whether they have accessed (or have access to) supplier finance arrangements that provide them with extended payment terms or that provide their suppliers with early payment terms.

|

For the further detail, and to view the full amendment please refer to ifrs.org.

Authors:

Justine Lewis, IFRS Manager

07 July 2023