Am I getting it right?

In the wake of corporate scandals and the rise in the adoption of fair value accounting by the standard setters, more time and energy are required to get to more accurate numbers, than ever before. Judgements and estimates are by their very nature subjective and getting them wrong could result in inaccurate and misleading financial statements that impact a wide range of stakeholders.

We have seen a laundry list of company names that have recently been associated with financial statement manipulation and many are asking “Where was the auditor in all of this?” The auditor plays a critical role as a watch dog over the financial statements and protecting the interest of the public. A major risk for auditors, investors and credit providers is the misuse of accounting judgments and estimates by the preparers of financial statements. Between the revised ISA 540 Auditing Accounting Estimates and Related Disclosures emphasising the role of the auditor to perform robust audit procedures over estimates and its disclosure, and the Proactive Monitoring team of the JSE, who has issued annual findings (since its inception in 2013) on the disclosure of judgements and estimates; it has become very clear that the auditor is expected to challenge management on their assumptions and to ensure that the user of the financial statements are aware of the those that most significantly impact the financial statements.

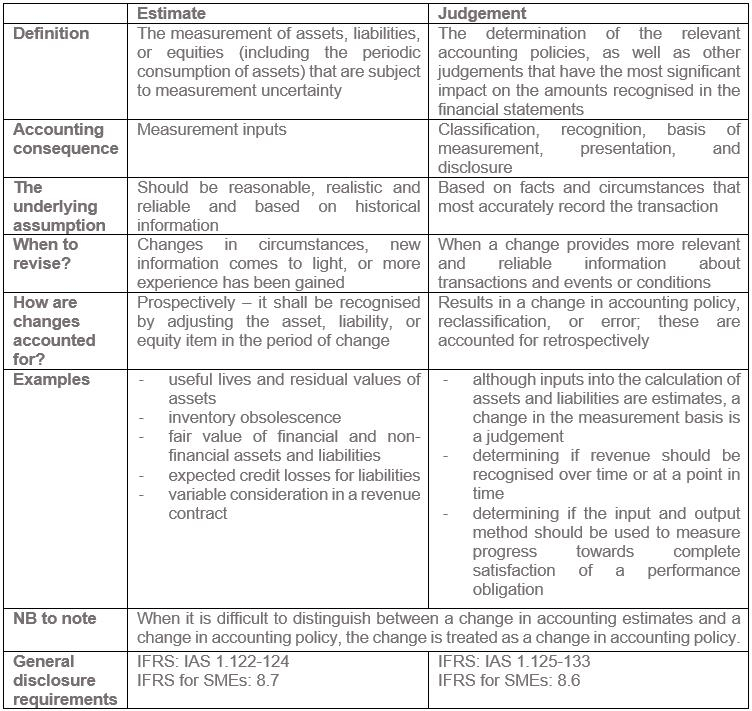

Although some would like to debate, judgements and estimates are interlinked as both are highly subjective and impact the financial statements. Because of this very subjective nature, they should be determined in good faith and disclosed adequately in the financial statements. It is important to have a fundamental understanding of the differences between judgements and estimates. In 2018, the JSE stated in the Report Back on Proactive Monitoring of Financial Statements that judgements and estimates should be clearly differentiated.

This is the first in a series of articles, discussing the differences between judgements and estimates, providing a practical approach to their application and their disclosure requirements.

To make life simple, here is a table demonstrating the differences between a judgement and an estimate.

The distinction between judgements and estimates are important as the incorrect classification could result in the incorrect paragraphs of IFRS being applied and insufficient information being disclosed.

30/09/2022