The joys of JIBAR

Phase two of the Interest Rate Benchmark Reform became effective from 1 January 2021, there has been no replacement rates in South Africa… what now?

Interbank offered rates (IBORs) are interest rates that are used as a reference representing the cost of obtaining unsecured financing combining currency, maturity and a particular lending market. It’s the rates that banks borrow at in the interbank market and a key benchmark for setting interest rates on loans, mortgages, corporate debt, derivative and money market unit trusts. In South Africa, extensive reference is made to the three-month JIBAR (Johannesburg Interbank Rate).

Over the last decade the LIBOR, London interbank market rate, was rocked by scandals and crises, being manipulated to achieve certain objectives – it was no longer a reliable reference. This also brought into question the long-term viability of the other benchmarks. The global Financial Stability Board revisited the makeup of these rates and as part of the reform, alternative reference rates became the new ‘benchmark’.

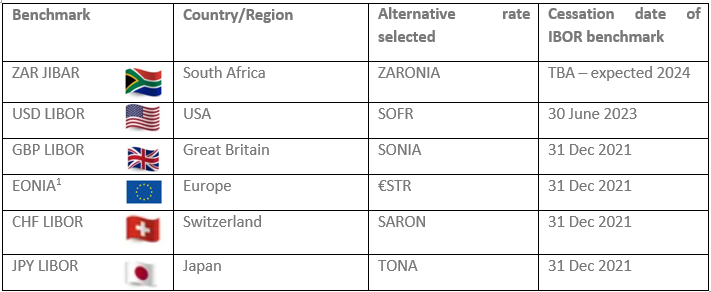

The (proposed) alternative reference rates:

The International Accounting Standards Board (‘IASB’), in reaction to the reform reached out to stakeholders and identified two groups of accounting issues related to the reform of benchmark rates. The Board approached the reform in two phases:

- Phase 1: Targeted relief for users of hedge accounting (effective 1 January 2020)

- Phase 2: Targeted key reliefs around the changes to contractual cash flows and additional hedge accounting relief (effective 1 January 2021)

The impact of the Phase 2 Amendments include the following:

1. Contractual and cash flow changes to be treated as changes due to a floating rate of interest.

In other words, the changes impacting a loan or lease, etc, due to a change in the reference rate caused by the IBOR reform does not need to be treated as a modification; the practical expedient allows for the asset or liability to be remeasured with the adjustment recognised in profit or loss.

€STR is the average overnight reference rate for which European banks lend one-day loans to one another in Euros.

2. Changes to hedge designations and documentation do not result in the discontinuation of the hedge relationship. The hedge will continue to be recognised, even if the underlying rate changes.

3. The ‘separately identifiable’ requirement is not required when a risk-free rate instrument is designated as a hedge of a risk component.

4. Additional disclosures to be made.

This is all well and fine, but what happens in a situation where an entity has a loan, lease, etc with a reference to an IBOR, such as JIBAR, or the US LIBOR that hasn’t changed yet?

The first thing to note is that this requirement is already effective. The detail can therefore be presented in the disclosure of new standards or interpretations applied in the year, it can be presented in the notes that will be impacted, or in the forward-looking notes.

Wherever the disclosure is made, it is important to disclose that the entity has loans or leases, etc that reference to an IBOR that is likely to change, mention should be made that the IBOR has not yet been changed and that the effect cannot yet be determined.

Examples of this disclosure are as follows:

| |

|

|

In summary, the JIBAR will change. When? Well, that remains to be seen. Even if we do not know what and when, it is important that users understand what assets or liabilities will be impacted by the change.

12/05/2022