A tale of two SOCIs

Unfortunately IAS 1 Presentation of Financial statements (and IFRS for SME section 5 Statement of Comprehensive Income and Income Statement ) does not describe the meaning of “nature” or “function”, nor does it provide much guidance on the appropriate presentation of the SOCI using these formats. The result has been a rather diverse and inconsistent implementation by preparers of financial statements, which has caught regulators’ attention. They are, among other things, questioning that entities do not always strictly stick to one format or the other, sometimes using a mixture of the two and ultimately applying neither fully or correctly.

What is meant by “by nature” and “by function”?

The presentation of a SOCI “by nature” or “by function” refers to the basis on which an entity groups and presents its expenses. In other words, expenses are either grouped together according to their nature or their function.

By function

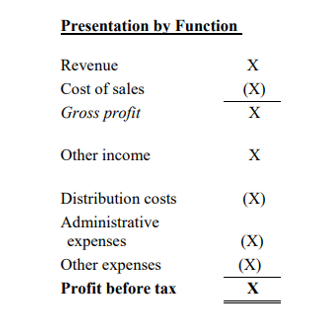

The presentation of expenses “by function” means that expenses are combined according to the activities or functions from which they arise (the standard refers to it as a function as part of cost of sales). Examples of functions within an entity include the sales function, administrative function, distribution function and financing function. A SOCI by function discloses “sales”, “cost of sales” and “gross profit”. The following example is provided by IAS 1:

When presenting a SOCI by function, costs directly associated with generating revenues should be included in the “cost of sales” line item. This includes direct material and labour costs as well as other costs that can be directly attributed to generating revenue; for example, depreciation, amortisation and impairment of assets used in production.

By nature

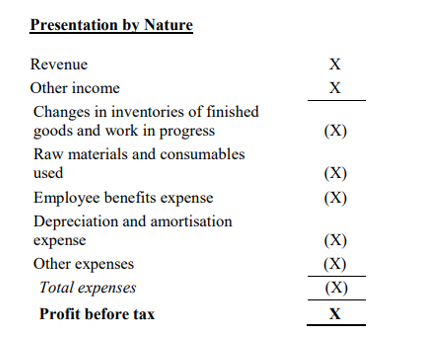

The presentation of expenses by nature groups expense together according to the type of resources that are consumed in an entity’s business activities. Examples of categories include raw material purchases, employee benefits, depreciation of equipment and amortisation of intangibles; these costs are not reallocated among the various functions within the entity.. IAS 1’s example is presented as follows:

Choosing a presentation format

Entities should choose the presentation format that is most relevant to their business. Some industries, such as manufacturing or retail, find that the “function of expense” method is more useful, because it is more descriptive of the entity’s operations in presenting revenue, cost of sales and gross profits. Other industries, for example banking or other service entities, have only one main function (e.g. financing activities), and for these entities a more detailed analysis of expenses according to their nature makes more sense.

It is important to remember that when presenting a SOCI by function, entities applying full IFRS are still required to disclose their expenses by nature in the notes to the financial statements (this does not apply to the IFRS for SMEs).

Mixing it up

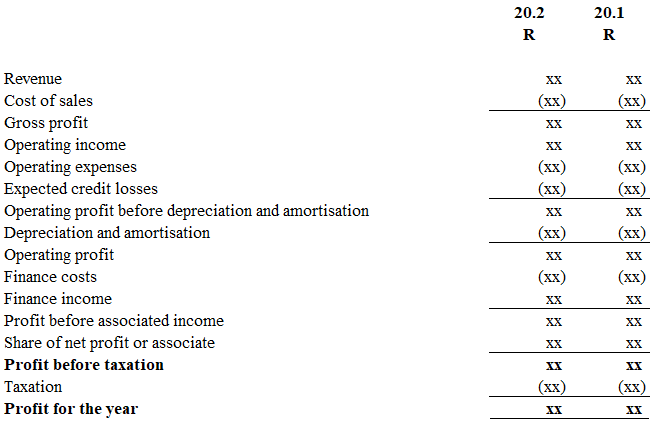

As mentioned earlier, regulators are concerned that entities have taken to presenting a mixture of the two formats. An example a mixed presentation is as follows:

In the above example, the entity has disclosed sales and cost of sales, indicating a functional classification. However, it has also disclosed total depreciation and amortisation as a separate line item, without allocating the appropriate portion to cost of sales. This mix of the function and nature classification of expenses means that depreciation and amortisation is excluded from the functional classification (e.g. cost of sales) to which it relates.

Does this mean that expenses cannot be presented separately on the face of a functional SOCI?

Not necessarily. If, in the above extract, the appropriate portion of depreciation and amortisation had been included in cost of sales, it would have been acceptable to disclose the remaining depreciation and amortisation as a separate line item on the face of the SOCI, with the notes to the financial statements presenting the full depreciation and amortisation expense and the various SOCI line items in which it has been included.

What about ECL’s…

Entities must report expected credit losses in terms of IFRS 9 Financial Instruments on the face of the SOCI, regardless of whether it is presented by nature or by function. In a functional SOCI the expected credit losses must be split and grouped with the relevant functions (where applicable). This principle also applies to any other individual items of income and expenses that are disclosed separately on the face (IAS 1 allows such separate presentation for items where their size or nature is relevant to understanding the entity’s financial performance).

… and operating profit?

The operating profit line item has also come under scrutiny again recently.

While IFRS does not require the presentation of “operating profit”, many entities voluntarily report this line item, or a similar line such as “trading profit” or “profit from operations”. These terms are not defined, but if entities do report them; IAS 1 requires that the amount disclosed is representative of activities that would normally be regarded as “operating”. Items of an operating nature may not be excluded, even if this has been industry practice. For example, it would be inappropriate to exclude items clearly related to operations, such as inventory write-downs and restructuring and relocation expenses, because they occur irregularly or infrequently or are unusual in amount. Similarly, it would be inappropriate to exclude items on the basis that they are non-cash transactions, for example impairments, depreciation or amortisation.

In light of the above, it may be difficult to justify the exclusion of items from operating profit. This view is shared by the JSE, who in their November 2021 pro-active monitoring report went so far as to say that “it is difficult to envisage which expenses, if any, would not be regarded as being part of an entity’s operating activities.”

Entities should also consider the inclusion of equity accounted earnings from associates and joint ventures in their operating profit. It has been common practice to present equity accounted earnings outside of operating profit, after the interest income and expense line items and right before “profit before tax”. This is often thought to best reflect the nature of this amount as an after-tax investment return. However, if the entity’s associates and joint ventures are integral to the entity’s operations and strategy, their equity accounted earnings should be included in operating profit.

The bottom line…

The presentation of the SOCI and its various line items will not affect the bottom line, but should nevertheless be considered by entities if they wish to avoid arduous enquiries from regulators on the topic.

26/05/2022