How to calculate impairment using the IFRS 9 simplified approach

How to calculate impairment

There are two methods of calculating the expected credit losses; A. The general approach, and

B. The simplified approach.

When applying the general approach, an assessment has to be made of the stage in which the debt falls as this will affect whether 12-month or lifetime expected credit losses should be recognised. When applying the simplified approach, we do not assess in which stage the debt falls as we always recognise lifetime expected credit losses.

In this article, we will have a look at when the simplified approach can be applied and how to go about the calculation of expected credit losses.

For which financial assets can the simplified approach be applied?

For the following financial assets, the simplified approach must be applied: | For the following financial asset, you can choose the simplified approach or the general approach: |

|

|

IFRS 9 contains a practical expedient that allows the use of a provision matrix to calculate the lifetime expected credit losses under the simplified approach.

HOW WOULD YOU GO ABOUT CALCULATING THE EXPECTED CREDIT LOSSES ON A PROVISION MATRIX?

The example on the following page is a very simple example to illustrate the basic principles of the simplified approach. Take note that the effect of time value of money has not been incorporated into this example.

Step 1: Group trade receivables into portfolios based on shared credit characteristics

The objective of this step is to split the trade receivables into portfolios, which have the same, or similar loss patterns.

The following characteristics can help in identifying the different portfolios:

- type of instrument,

- collateral type,

- industry, or

- credit risk rating,

- term to maturity,

- geographic location.

Remember to include disclosure in the financial statements on how instruments were grouped. [IFRS 7.35F(k)]

For example, if you have a debtors’ book consisting of retail customers within South Africa and Zimbabwe, the credit risk profile of the debtors from the two countries may vary significantly. The debtors may have the same repayment terms and may operate in the same industry, but the credit risk profile may be very different. Zimbabwe is at risk of a recession, and, therefore, you would probably conclude that the South African debtors will form one portfolio, with the Zimbabwean debtors forming a separate portfolio based on their credit risk characteristics.

Step 2: Define a period of sales and credit losses relating to those sales

The purpose of this step is to determine a period over which to review the credit loss history of the entity to develop an understanding of the loss trends regarding trade receivables. This period must not be so short that the information is not meaningful/representative of reality but must also not be too long, which results in ignoring market information and changes in the customer base. Entities will need to apply their judgement in concluding on a period over which to monitor historical losses that makes sense and results in reliable and relevant information in calculating credit losses. The period could be anything from 12 to 60 months - any shorter or much longer risks, the information on which the matrix is based, being either not representative or potentially outdated.

Step 3: Calculate the payment profile of trade receivables

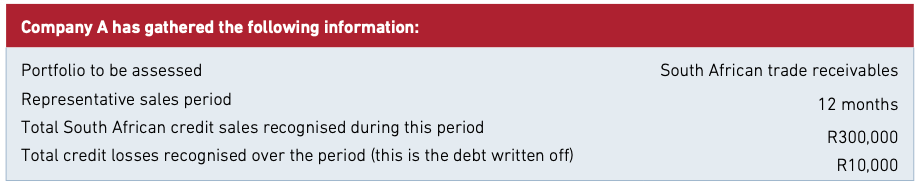

Let's illustrate how this calculation could look:

The debtors have 30-day repayment terms. This means that there is no significant financing component and you don’t have to worry about discounting any figures. This can be up to a year if applying the IFRS 15 practical expedient for significant financing components.

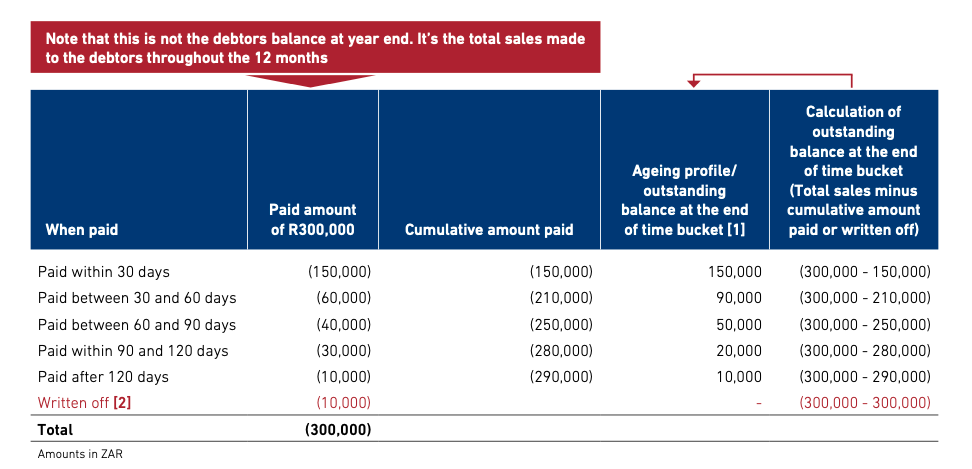

The purpose of this step is to calculate the outstanding balance of trade receivables at the end of each time bucket up to the point where amounts are written off as irrecoverable.

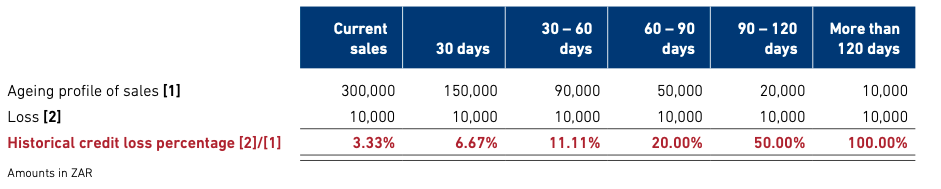

Step 4: Calculate the historic credit loss percentage.

Calculate this by dividing the loss of R10,000 determined above by the unpaid amount in each age band.

The loss of R10,000 is applied because it remained unpaid in each respective timeband until it was eventually written off.

Step 5: Adjust the historical credit loss percentage for forward-looking information

IFRS 9 requires forward-looking information to be considered in setting credit loss allowances and requires that this information must adjust the credit loss percentages applied in measuring the allowances. This is likely to require the most judgement. Forward-looking information to consider should include micro- and macroeconomic factors such as unemployment rates, economic growth and outlooks, the regulatory and technological environment, external market indicators and expected changes in the customer base.

An entity must find the macroeconomic factors that could affect its credit losses. This will be different for each entity/industry.

When there is a linear relationship between the macroeconomic factor (i.e. unemployment rate) and the input (i.e. increase/decrease in collection of receivables), then the incorporation is quite simple. When the relationship is not linear, then the adjustment might require some modelling and may require the use of an expert.

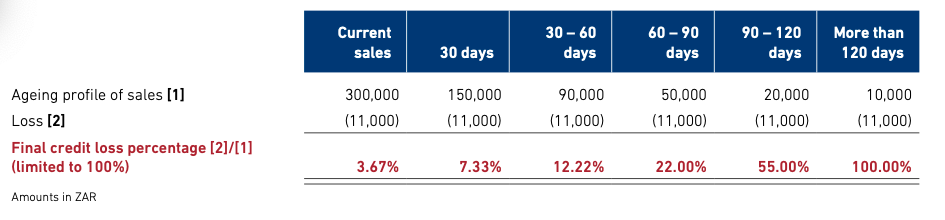

For illustration purposes, let’s assume that when the unemployment rate increases by 1%, it triggers a default loss of 10%. Please note that entities should be able to prove this.

Based on economic forecasts, Company A expects the unemployment rate to increase with 1%, and as a result, Company A increases the credit loss percentage calculated in Step 4 with 10% (R10,000 x 110% = R11,000).

Remember to disclose, in the notes to the financial statements, the forward-looking information applied. [IFRS 7.35G]

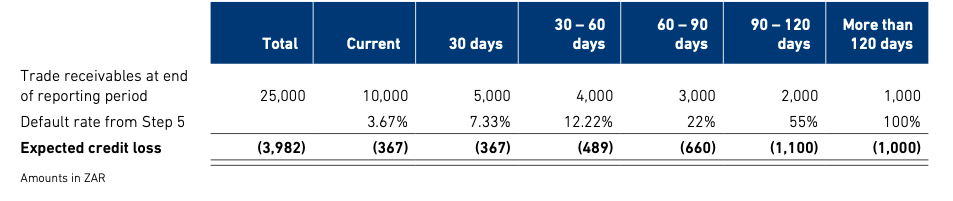

Step 6: Calculate the credit loss allowance at the end of the reporting period using the loss rates determined

To calculate the impairment at year-end, apply the loss percentage calculated in Step 5 to the debtors’ balances for the South African portfolio at year-end.

The carrying value of South African trade receivables is R22,018 (R25,000 minus R3,982 impairment losses) at year-end.

This calculation process must be reperformed at each reporting period and is expected to change year on year.

The method may be the “simplified approach”, but it does not necessarily indicate that the calculation is simple. There are still judgements to be made, especially concerning the forward-looking information. It is important to understand the debtors’ book and to assess whether experts should be involved in the calculation at an early stage.

Author: Nelia Joubert, Manager IFRS, Quality and Risk Management.